Paul B Insurance Medicare Part D Huntington - The Facts

Wiki Article

The Greatest Guide To Paul B Insurance Medicare Agency Huntington

Table of ContentsThe Ultimate Guide To Paul B Insurance Medicare Part D HuntingtonLittle Known Questions About Paul B Insurance Medicare Advantage Agent Huntington.

Health insurance pay defines amounts for clinical costs or therapy as well as they can use many alternatives as well as differ in their methods to insurance coverage. For assist with your details problems, you may wish to speak with your employers benefits division, an independent expert consultant, or get in touch with MIDs Customer Services Department. Getting medical insurance is an extremely crucial choice (paul b insurance medicare advantage plans huntington).

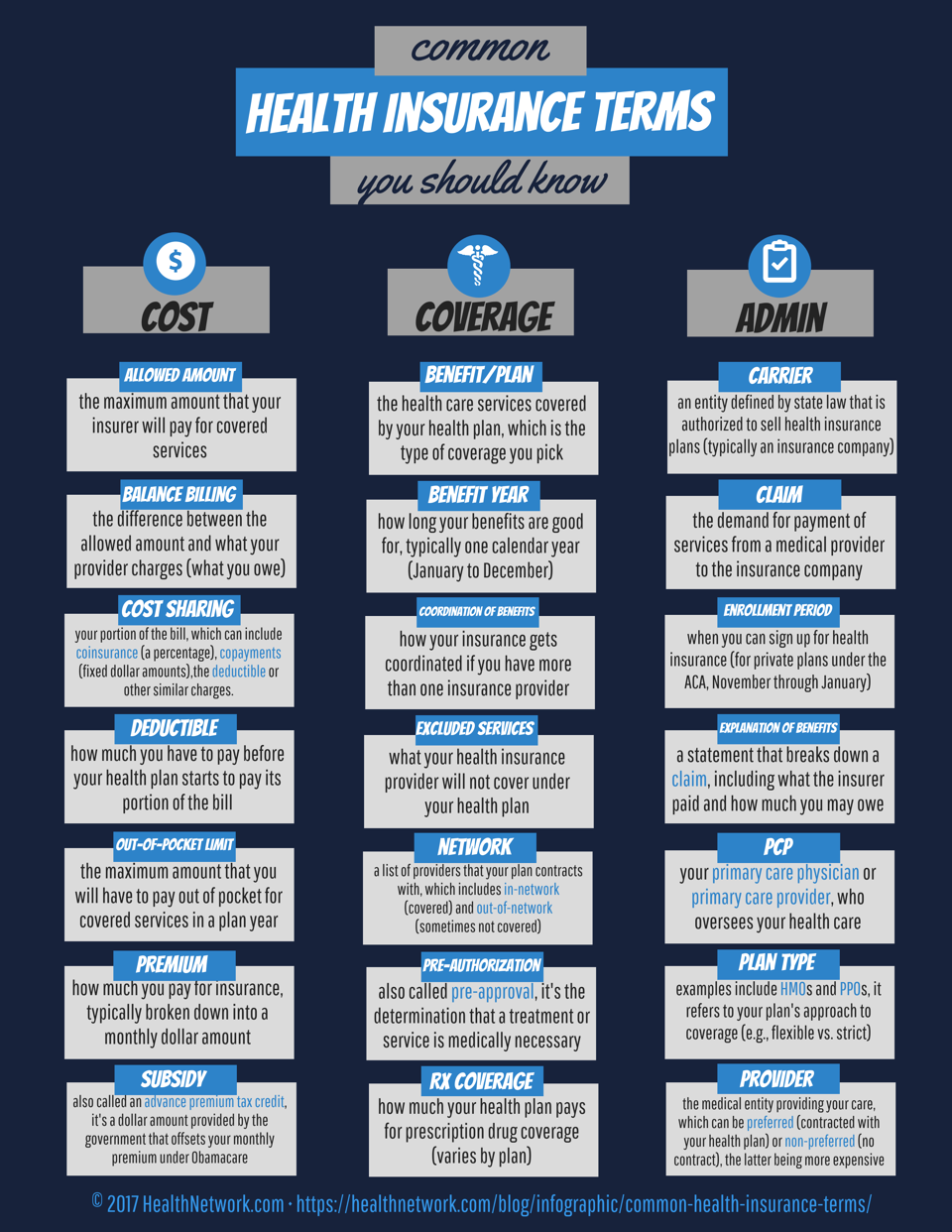

Many often tend to base their whole insurance coverage purchasing choice on the costs quantity. In addition to getting a great worth, it is additionally essential that you take care of a company that is solvent. There are several different type of medical insurance. Standard insurance policy usually is called a"cost for service "or"indemnity"plan. If you have traditional insurance policy, the insurance firm foots the bill after you get the service. Handled care plans use your monthly payments to cover most of your medical expenses (paul b insurance Medicare Supplement Agent huntington). Health Care Organizations(HMOs) and also Preferred Supplier Organizations(PPOs )are the most typical handled treatment companies. Handled treatment strategies motivate and sometimes require customers to use physicians and medical facilities that belong to a network. In both standard insurance coverage and also handled treatment plans, consumers might share the price of a service. This price sharing is.

often called a co-payment, co-insurance or insurance deductible. Various terms are used in going over health and wellness insurance coverage. "Carriers"are physicians, hospitals, drug stores, labs, immediate care facilities and also various other healthcare centers as well as experts. Whether you are thinking about enlisting in a standard insurance plan or handled treatment plan, you should know your legal civil liberties. Mississippi regulation calls for all insurers to clearly and also honestly reveal the complying with info in their insurance plan: A total checklist of products as well as services that the healthcare plan pays for. State regulations restrict for how long preexisting condition exemption periods can be for private as well as team health and wellness strategies. If you have a group wellness plan, a pre-existing problem is a health condition for which medical recommendations, diagnosis, treatment or treatment was recommended or obtained within 6 months of joininga strategy. If you have a specific strategy, a pre-existing condition is a health and wellness problem for which medical recommendations, diagnosis, treatment or treatment was suggested or received within year of joining your strategy. Your plan may refuse to pay for services connected to your pre-existing condition for one year. You might not have to serve a pre-existing condition exclusion period if you have the ability to obtain credit report for your wellness care insurance coverage you had prior to you joined your brand-new plan. Ask your prepare for even more information. Your health and wellness insurance firm need to renew your plan if you wish to renew it. The insurance provider can not terminate your plan unless it takes out of the Mississippi market totally, or you devote scams or misuse or you do not pay your premiums. All healthcare plans have to have composed treatments for obtaining as well as dealing with grievances. Grievance treatments should be regular with state law needs. If your wellness insurance firm has rejected to pay for healthcare solutions that you have actually received or wish to receive, you can recognize the exact contractual, clinical or other factor why. If you have a complaint about a health insurance provider or a representative, please refer to our File a Grievance Web Page. However, keep in mind that when you are contrasting business as well as asking for the variety of problems that have actually been filed versus a firm, you must realize that normally the business with one of the most plans active will certainly have a lot more issues than companies that only have a couple of policies in position. Every took care of treatment strategy must submit a description of its network of carriers and how it makes certain the network can offer healthcare services without unreasonable delay. Occasionally, a physician, healthcare facility, or various other health care facility leaves a handled care plans network. When this takes place, a managed care strategy should notify you if you saw that provider regularly.

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)

You need to obtain this list when you sign up, re-enroll, or upon request. Every took care of care strategy have to hug track of the quality of the health and wellness care solutions it gives. Managed treatment plans should not make use of benefits or charges that urge less care than is medically required. If you would like to know even more about exactly how your plan pays its companies, you should ask. The notification needs to consist of the major reasons for the rejection and guidelines on how to appeal. Every managed care strategy must follow particular treatments if it figures out that a healthcare service was not medically essential, efficient, efficient or proper. The procedures need to be totally defined in the certificate of coverage or member manual. You need to make a list of your demands to contrast with

The 5-Minute Rule for Paul B Insurance Medicare Part D Huntington

the advantages provided by a plan you are thinking about. You need to contrast strategies to learn why one is more affordable than another. Provided listed below are some inquiries you should ask when searching for medical insurance: What does the strategy spend for and also not spend for? Will the strategy spend for preventative care, immunizations, well-baby care, drug abuse, organ transplants, vision care, dental care, inability vsp vision insurance to conceive treatment, or durable clinical equipment? Will the plan pay for any prescriptions? If it pays for some, will it spend for all prescriptions? Does the plan have mental health benefits? Will the plan spend for lengthy term physical treatment? Not all strategies cover all of the advantages listed above. Do prices boost as you age? Just how usually can rates be altered? Exactly how much do you need to pay when you obtain healthcare services(co-payments and also deductibles)? Are there any restrictions on just how much you must spend for wellness care solutions you obtain(out of pocket optimums)? Exist any restrictions on the number of times you may obtain published here a service(life time optimums or yearly benefit caps)? What are the constraints on using carriers or solutions under the plan? Does the health strategy need you to.see providers in their network? Does the health plan spend for you to see a doctor or make use of a medical facility outside the network? Are the network service providers conveniently found? Is the physician you desire to see in the network accepting brand-new clients? What do you need to do to see a specialist? How very easy is it to get an appointment when you require one? Has the firm had an abnormally high variety of customer complaints? What takes place when you call the business customer complaint number? The length of time does it require to reach a real individual? Married couples in situations where both spouses are offered health insurance policy through their work must compare the insurance coverage and prices(premiums, co-pays as well as deductibles)to identify which plan is best for the family members. Maintain all receipts for medical solutions, whether in -or out-of-network (paul b insurance insurance agent for medicare huntington). In the occasion you exceed your insurance deductible, you may certify to take a tax obligation deduction for out-of-pocket clinical bills. Consider opening a Flexible Spending Account (FSA ), if your employer uses one, which allows you to reserve pre-tax bucks for out-of-pocket clinical expenses. As an example: who might not yet have a permanent work that offers wellness advantages need to know that in an expanding number of states, single grown-up dependents may be able to remain to get health protection for a prolonged period( varying from 25 to thirty years old)under their parents 'medical insurance plans even if they are no more full time pupils. with kids must think about Flexible Spending Accounts if my link available to aid spend for common childhood years medical troubles such as allergic reaction tests, braces and replacements for lost spectacles, retainers and so on, which are frequently not covered by basic medical insurance

All workers who lose or change jobs should recognize their civil liberties to proceed their health insurance coverage under COBRA for as much as 18 months. At this life phase, consumers may intend to examine whether they still require impairment insurance policy. Lots of will intend to choose whether long-lasting treatment insurance policy makes good sense for them(e. g., will certainly they be able to pay for the costsright into aging, when most need to make use of such coverage). If we can be helpful, please see the Demand Aid Page for details on copyright us. Medical insurance is very important to have, but it's not always understandable. You might have to take a couple of actions to make certain your insurance coverage will spend for your healthcare bills. There are additionally a great deal of keywords as well as expressions to keep right in your head. Below's some basic information you require to recognize: Medical insurance helps pay for your health treatment. It also covers lots of precautionary services to keep you healthy and balanced. You pay a regular monthly expense called a premium to purchase your wellness insurance policy as well as you may have to pay a section of the expense of your care each time you get clinical services. Each insurance coverage business has different guidelines for using healthcare benefits. In general, you will give your insurance detailsto your physician or health center when you choose treatment. The doctor or medical facility will certainly bill your insurance provider for the solutions you get. Your insurance card confirms that you have medical insurance. It has information that your physician or healthcare facility will use to obtain paid by your insurer. Your card is additionally helpful when you have inquiries about your wellness coverage. There's a contact number on it you can call for info. It might also provide basics about your health insurance as well as your co-pay for workplace gos to. Doctors as well as healthcare facilities frequently contract with insurance provider to become component of the firm's"network."The agreements define what they will be spent for the care they give. Some insurance coverage prepares will certainly not pay anything if you do not make use of a network company (except in the situation of an emergency ). It is essential to get in touch with the plan's network prior to looking for treatment. You can call your insurer utilizing the number on your insurance card. The business will inform you the medical professionals and also medical facilities in your location that belong to their network.

Report this wiki page